Tokenizasyon is becoming one of the most talked-about technologies in the digital world today. But what does it really mean? Why is everyone – from big banks to small online stores – rushing to use tokenizasyon? And more importantly, how does it make your online transactions safer? In this guide, we’ll break it all down in plain language. Whether you’re a business owner, a tech enthusiast, or just someone curious about digital security, this article will help you understand tokenizasyon fully.

What Does Tokenizasyon Mean?

Tokenizasyon is a process that replaces sensitive data, like credit card numbers or personal details, with unique symbols called tokens. These tokens have no meaningful value if stolen because they don’t reveal the original information.

Imagine your sensitive data as a gold coin. Tokenizasyon takes that coin and locks it in a vault. Then it gives you a fake coin (token) to use in the outside world. Even if someone steals this fake coin, they can’t get into the vault. Only the authorized system that created the token knows how to swap it back for the real thing.

In simple words, tokenizasyon keeps important information safe by hiding it behind a wall of meaningless codes.

How Does Tokenizasyon Work?

Tokenizasyon works like a translator between the real world and the digital world. When sensitive data enters a system (like a credit card number during a payment), tokenizasyon software replaces it with a randomly generated token. This token is stored in the system’s database instead of the original data.

Later, when the original data is needed for processing (like completing a payment), the system calls back the real information from a secure token vault. The vault is protected with strict access controls, encryption, and security measures.

This method ensures that even if a hacker gains access to the database, all they find are useless tokens. No original data means no risk of theft.

What Is a Token?

A token is a randomly generated string of characters that represents real data without revealing any part of it. For example:

- Original Credit Card Number: 1234 5678 9012 3456

- Tokenized Version: a9b8c7d6e5f4g3h2i1j0

The token looks nothing like the original number. It can’t be reversed without access to the token vault, making it completely useless for cybercriminals.

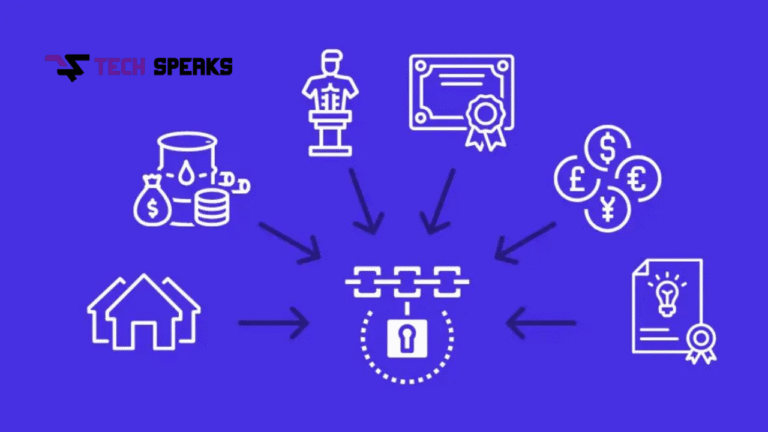

Who Uses Tokenizasyon?

Many industries now rely on tokenizasyon because of growing cybersecurity threats. Here are some examples:

- Financial institutions use it to protect customer payment data.

- E-commerce websites use tokenizasyon to secure online transactions.

- Healthcare providers apply tokenization to store patient data safely.

- Cloud service providers use it to protect data stored across networks.

- Even social media platforms implement tokenization to secure user credentials.

Basically, any organization dealing with sensitive information can benefit from this technology.

Is Tokenizasyon Safe?

Yes, tokenizasyon is considered one of the safest data protection methods available today. Since tokens have no value outside the system, they dramatically reduce the risk of data breaches.

Unlike encryption keys, tokens don’t need to be decrypted, which lowers the chance of exposing sensitive information during use.

Benefits of Tokenizasyon for Businesses

Businesses of all sizes are turning to tokenizasyon to strengthen their cybersecurity. Here’s why:

- Protects Customer Trust: When customers know their data is secure, they’re more likely to buy.

- Compliance with Regulations: Tokenizasyon helps meet standards like PCI DSS, HIPAA, and GDPR.

- Reduces Financial Losses: Data breaches are expensive. Tokenization prevents them by removing valuable data from exposure.

- Simplifies Data Management: Businesses don’t have to handle sensitive data directly, reducing operational complexity.

- Enables Safer Cloud Adoption: Tokenizasyon protects data stored and processed in the cloud.

In short, tokenizasyon is not just a security measure; it’s also a competitive advantage.

Tokenizasyon vs Encryption: What’s the Difference?

People often confuse tokenizasyon with encryption, but they’re very different.

- Encryption uses algorithms to convert data into unreadable code. This code can be reversed (decrypted) using a key.

- Tokenizasyon, on the other hand, replaces data with unrelated tokens. There’s no mathematical relationship between the token and the original data.

Here’s an easy analogy:

- Encryption is like writing a secret message in code.

- Tokenization is like replacing the secret message with a blank piece of paper labeled “Message #1” and keeping the real message in a secure vault.

If an attacker gets encrypted data, they can attempt to decrypt it. But if they get tokenized data, they get nothing they can use.

Which One Is Better?

There’s no one-size-fits-all answer. It depends on the use case:

- Encryption is better for securing data in transit (like emails).

- Tokenization is better for securing stored data (like credit card databases).

In many cases, organizations use both together. For example, encrypted data can also be tokenized to add another layer of security.

Where Is Tokenizasyon Used Today?

Tokenizasyon is everywhere – though you might not notice it. Some common uses include:

- Mobile payments (Apple Pay, Google Pay)

- Online shopping platforms (Amazon, Shopify)

- Healthcare apps and portals

- Banking systems and ATMs

- Cloud storage services

- Loyalty and reward programs

The technology is quietly working in the background every time you make a secure digital transaction.

Common Questions About Tokenizasyon

- Can tokens be hacked?

- No. Tokens themselves are meaningless without access to the secure token vault.

- Does tokenization slow down systems?

- Not at all. Modern tokenization systems are designed for high-speed transactions.

- Is it expensive?

- Costs vary, but the price of not using it (data breaches) is much higher.

Future of Tokenizasyon

The future of tokenizasyon looks bright as cybersecurity threats continue to grow. Emerging trends include:

- Blockchain-based tokenization: Bringing even more security and transparency.

- AI-powered token management systems: For smarter, faster operations.

- Global regulations pushing tokenization adoption: Especially in finance and healthcare.

Soon, tokenization may become the standard way to handle all forms of digital data.

Words on Tokenizasyon

Tokenizasyon is no longer optional in today’s digital world. With cyberattacks becoming more sophisticated, protecting sensitive data is more important than ever. Whether you’re running a business or just using online services, tokenization is working behind the scenes to keep your information safe.

The Bottom Line

In simple terms, tokenizasyon acts like an invisible shield around your sensitive data. It replaces valuable information with meaningless tokens so that even if cybercriminals breach a system, they get nothing useful.

For businesses, it’s a cost-effective, secure, and smart way to comply with data protection laws while keeping customer trust. For individuals, it’s peace of mind every time you shop, bank, or share information online.

As technology evolves, tokenization will likely become even more powerful and widespread. In the battle against cybercrime, it’s one of our best defenses.